The Ultimate Guide To Pkf Advisory Services

The Ultimate Guide To Pkf Advisory Services

Blog Article

The Pkf Advisory Services Statements

Table of ContentsThe 5-Minute Rule for Pkf Advisory Services5 Simple Techniques For Pkf Advisory ServicesThe 5-Minute Rule for Pkf Advisory ServicesOur Pkf Advisory Services IdeasNot known Details About Pkf Advisory Services

Lots of people nowadays understand that they can not rely upon the state for greater than the absolute basics. Planning for retirement is an intricate business, and there are several options available. An economic consultant will certainly not only aid filter with the lots of policies and product alternatives and assist create a profile to maximise your long-term prospects.

Acquiring a house is among the most pricey decisions we make and the huge bulk people require a home loan. An economic adviser can conserve you thousands, specifically sometimes like this. Not only can they seek the very best rates, they can assist you examine practical levels of borrowing, maximize your down payment, and might additionally find lending institutions that would certainly or else not be offered to you.

Some Of Pkf Advisory Services

A monetary advisor knows just how items work in various markets and will determine possible drawbacks for you as well as the possible benefits, to make sure that you can then make an educated choice regarding where to spend. Once your danger and investment evaluations are full, the next action is to look at tax obligation; also one of the most standard summary of your placement could aid.

For more difficult plans, it can imply relocating assets to your partner or children to increase their individual allowances instead - PKF Advisory Services. A monetary consultant will always have your tax position in mind when making referrals and factor you in the right instructions even in complex circumstances. Also when your investments have actually been implemented and are going to strategy, they need to be kept an eye on in instance market developments or unusual events push them off program

They can examine their efficiency versus their peers, ensure that your asset allowance does not end up being altered as markets rise and fall and aid you consolidate gains as the deadlines for your ultimate objectives relocate better. Cash is a complex subject and there is whole lots to take into consideration to shield it and take advantage of it.

Some Ideas on Pkf Advisory Services You Need To Know

Employing a good financial consultant can reduce with the buzz to guide you in the appropriate instructions. Whether you require basic, functional suggestions or a professional with committed proficiency, you could find that in the long term the cash you buy professional guidance will be repaid sometimes over.

Maintaining these licenses and certifications needs continuous education and learning, which can be expensive and time-consuming. Financial consultants need to remain updated with the current sector patterns, policies, and ideal techniques to serve their customers efficiently. Despite these challenges, being a qualified and qualified financial advisor supplies tremendous benefits, consisting of many occupation opportunities and greater gaining possibility.

Get This Report on Pkf Advisory Services

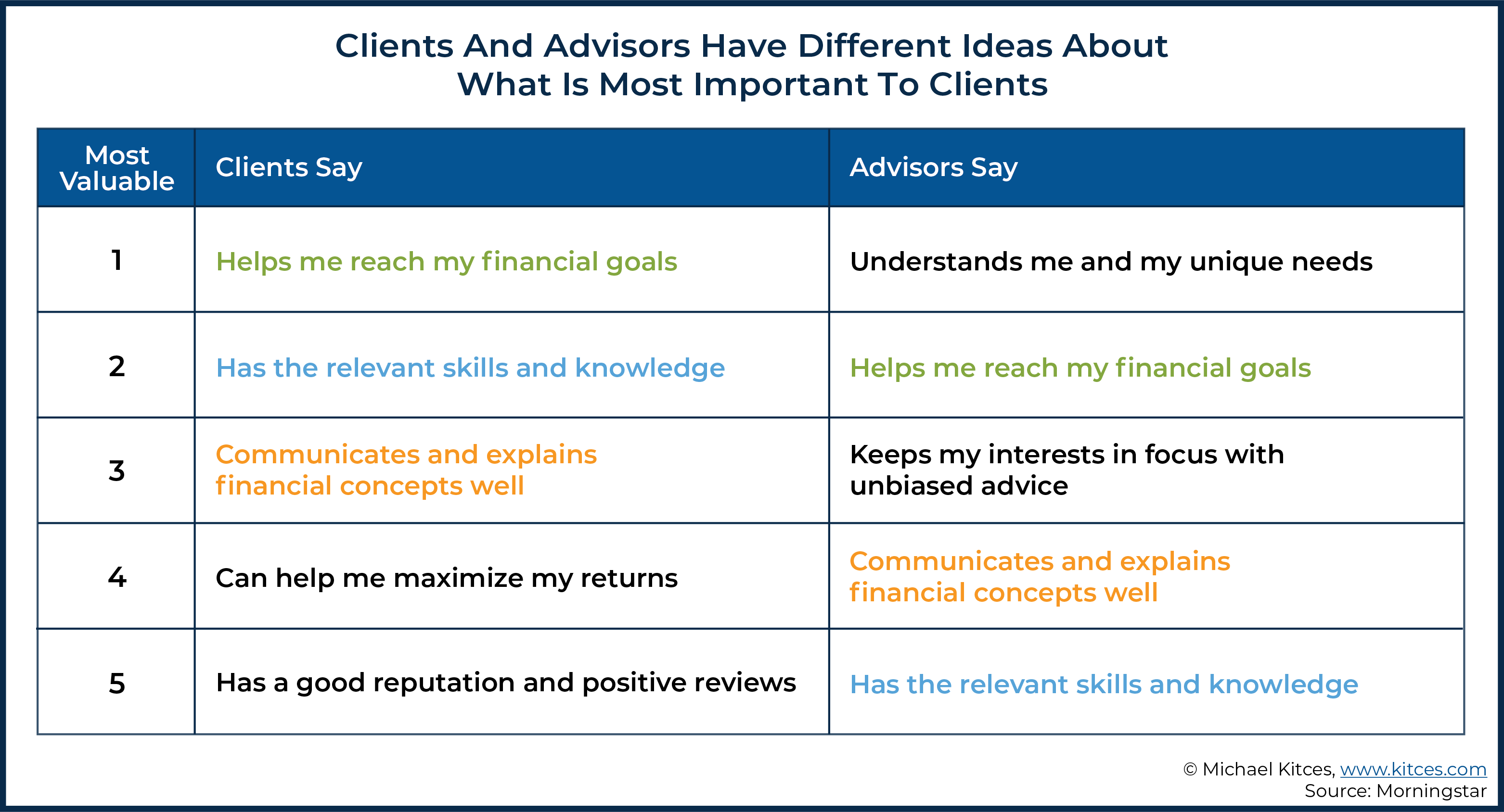

Empathy, analytical skills, behavior money, and outstanding interaction are paramount. Financial consultants function very closely with customers from varied backgrounds, helping them navigate complicated economic choices. The ability to listen, comprehend their distinct needs, and give customized advice makes all the distinction. Remarkably, prior experience in financing isn't always a prerequisite for success in this field.

I started my occupation in business financing, walking around and upward throughout the corporate finance framework to hone abilities that prepared me for the duty I am in today. My choice to move from company financing to personal finance was driven by individual demands along with the wish to assist the numerous individuals, families, and tiny services I currently serve! Attaining a healthy and balanced work-life balance can be challenging in the very early years of a monetary consultant's profession.

The monetary advisory profession has a favorable overview. It is expected to expand and evolve continually. The task market for personal economic consultants is projected to expand by 17% from 2023 to 2033, suggesting strong need for these services. This growth is driven by variables such as a maturing populace needing retirement planning and boosted useful content awareness of the significance of financial preparation.

Financial experts have the distinct capacity to make a considerable effect on their customers' lives, helping them attain their monetary goals and secure their futures. If you're enthusiastic regarding financing and helping others, this occupation path could be the ideal fit for you - PKF Advisory Services. To find out more details about ending up being a monetary advisor, download our detailed FAQ sheet

Pkf Advisory Services Can Be Fun For Anyone

If you would certainly like financial investment suggestions concerning your particular facts and conditions, please call a competent financial expert. Any type of investment involves some level of danger, and different kinds of investments involve differing levels of risk, including loss of principal.

Past efficiency of any type of protection, indices, technique or allocation might not be indicative of future outcomes. The historical and existing information regarding policies, laws, standards or benefits consisted of in this paper is a summary of info acquired from or additional info prepared by various other sources. It has not been individually verified, but was go to my blog acquired from resources thought to be reliable.

A monetary expert's most valuable asset is not expertise, experience, or even the capability to create returns for customers. It's trust, the foundation of any type of effective advisor-client partnership. It sets an advisor aside from the competition and maintains customers returning. Financial specialists throughout the nation we talked to concurred that trust is the essential to developing enduring, effective partnerships with customers.

Report this page